Recession Proof – Step 8

Workin’ 9 to 5

What a way to make a living

Barely getting by

Its all talkin

And no givin

They just use your mind

And they never give you credit

It’s enough to drive you

Do you remember singing that song? Just looking at the lyrics makes me think of Dolly Parton. Although I don’t recall ever seeing the movie Nine to Five starring the petite country singer and Jane Fonda, I’ve always remembered the melody of the song and the first two bars, “Workin 9 to 5 what a way to make a living…”

And it’s the fabulous Dolly that brings us to the next step in this 10-step program to create a Recession-Proof marriage and household. For those joining us today for the first time, I encourage you to go back and review Step One, Steps Two and Three, Step Four, Step Five, Step Six and Step Seven. For your ease, I’ve included a brief synopsis of each step below. But I definitely recommend taking the time to go back and read each step individually.

STEP ONE: Stop comparing yourself to others and learn to be content (or even better, happy) with exactly what you have in this moment. As Rick Warren said and I love repeating, “If the grass is greener on the other side, that’s because your neighbor has a higher water bill!”

STEP ONE: Stop comparing yourself to others and learn to be content (or even better, happy) with exactly what you have in this moment. As Rick Warren said and I love repeating, “If the grass is greener on the other side, that’s because your neighbor has a higher water bill!”

STEP TWO: Team up with your partner in life, your spouse, and pray for wisdom. This is different from the prayers you may have prayed until now. You’re not asking Him to magically make your debt disappear or magically increase your income. You’re asking Him for the wisdom to allow you to do it yourself. No one knows your financial future better than Him so that is the life source you want to stay connected to throughout this process and beyond.

STEP THREE: Strip down your image. There is no doubt that a part of the instruction God will give you will require great sacrifice and that means you will need to be okay with whatever anyone else may think of you. Don’t allow your fear of what others may think keep you straddled with the burden of debt. It’s just not worth it.

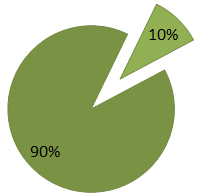

STEP FOUR: The 10/90 Rule. Many financial experts will tell you about the 80/10/10 rule and it is what Keith and I follow. But I learned early in my adult life that the 80/10/10 was a goal but for those desiring to financial freedom, the 10/90 rule is a requirement. It is what I used 15 years ago to turn my financial situation around and I’ve never met a person for whom it did not work.

Keith and I follow. But I learned early in my adult life that the 80/10/10 was a goal but for those desiring to financial freedom, the 10/90 rule is a requirement. It is what I used 15 years ago to turn my financial situation around and I’ve never met a person for whom it did not work.

STEP FIVE: Allowance isn’t just for kids. You’ve probably discovered, like most people I know, that budgets are similar to New Year’s Resolutions: everyone makes them but few actually follow them (at least beyond the first month or two). Budgets are usually blown but allowances are not.

STEP SIX: Redefine the American Dream. This step begins the process of helping you pay off your debt and learn to live below your means. Keeping up with the Joneses, Kardashians, Steins or anyone else is a recipe for failure. Defining the American Dream for yourself is the key to success.

STEP SEVEN: Let stuff go. Using the analogy of “how to catch a monkey” we’re reminded how our refusal to let some things go could cause us to remain in debt and not live the financially free life we were meant to enjoy. And like the monkey, who is caught because of his refusal to let go of a booby-trapped treat, our decision to “let go” can change one’s life.

STEP SEVEN: Let stuff go. Using the analogy of “how to catch a monkey” we’re reminded how our refusal to let some things go could cause us to remain in debt and not live the financially free life we were meant to enjoy. And like the monkey, who is caught because of his refusal to let go of a booby-trapped treat, our decision to “let go” can change one’s life.

And today we’re adding:

STEP EIGHT: Workin’ 9-to-5 is a movie and an award-winning song, not the way to obtain financial freedom.

When I first began writing this blog series on finances, I thought it would take a couple days. I’d share a few thoughts and hope you’d glean something great from it to begin on the path toward financial freedom. Quite frankly, I thought I was just going to share with each of you one of our favorite books, Dave Ramsey’s Total Money Makeover, and be done with it.

Now, two weeks and eight steps later, we are finally nearing the end of this series. We will be discussing step eight today, step nine on Wednesday and wrapping up with step ten on Friday. And then I can return to writing about much lighter topics. Yeah!!

So let’s talk about step eight. As I mentioned on Friday, for some of you, the first six steps in this plan for a Recession-Proof marriage is all you’ll need to get on the right track. But for those who find themselves buried in debt on a never-ending hamster will, selling excess might be necessary (step seven) and figuring out creative ways to bring more income into the family (step eight) may be required.

a Recession-Proof marriage is all you’ll need to get on the right track. But for those who find themselves buried in debt on a never-ending hamster will, selling excess might be necessary (step seven) and figuring out creative ways to bring more income into the family (step eight) may be required.

When times are tough, money is tight and the bills are mounting, obtaining multiple jobs may be necessary. A secondary job is never ideal, and it’s rarely anything enjoyable, but it may be necessary. Now, is the time to put your heads together as husband and wife or mom and dad and figure out how you can bring more money into your household. That may mean working one job from 7am-3pm and another from 4pm-10pm. It may mean working six days a week. Not fun… I know.

Working 12-hour days, 6 days a week is exhausting. I understand. My hubby understands. We’ve both done it multiple times throughout our careers. 70+ hours of work each week is definitely no laughing matter but it may be necessary for the time being to create more income for your family. And it should be temporary.

Set a goal of getting out of debt. Lay all your bills out and begin calculating the length of time it will take you to pay them all off (there are a ton of websites that can show you effective ways to do this – just Google it). Once you’ve determined how long it’ll take you to pay them off at your current household income, calculate how much time you can shave off of that by bringing in more money. The sooner you can get it done, the sooner you can experience the financial freedom you long to have.

There are many Club members who are stay-at-home moms and you might be one of them. If that’s the  case, you already know you have one of the most exhausting and underappreciated jobs in the world. But, and this may surprise you, it is also one that can potentially give you the flexibility to add another source of revenue to the family’s bottom line.

case, you already know you have one of the most exhausting and underappreciated jobs in the world. But, and this may surprise you, it is also one that can potentially give you the flexibility to add another source of revenue to the family’s bottom line.

There are a ton of creative ways to make more money (honestly and legally ![]() ) and if you even look online for testimonies, you’ll run out of time before you run out of success stories. But one of my favorite is making your services available through sites like Elance and Odesk and expanding your job opportunities from the US or wherever you are located to participating in the worldwide job market.

) and if you even look online for testimonies, you’ll run out of time before you run out of success stories. But one of my favorite is making your services available through sites like Elance and Odesk and expanding your job opportunities from the US or wherever you are located to participating in the worldwide job market.

When I mention Elance to people, it’s rare for me to come across someone who knows what I’m talking about. But this company has been a conduit for pairing work with qualified workers for some time now and contractors (people like you) have earned over $425 million on the Elance Platform (you can read an article here). I love Elance, I have contractors who work for me from California, Tennessee, Florida, Costa Rica, India, Argentina, Philippines and there are thousands of small business just like mine who look for talented workers through sites like Elance.

Many think these sites are only for workers from other countries who work for less than $5/hr. That is absolutely not true. My company, for example, pays no less than minimum wage here in the US – no matter where a worker is located. I’m here in the US so I try to hire as many US-based contractors as possible. The problem is not the amount of work available, it’s the number of people qualified to do the jobs here in the States.

No matter where in the world you’re located, here’s what I know, you have a computer because you’re reading my online blog. If you have a computer, you can learn the skills needed to earn extra income online. This isn’t one of those “work-from-home” schemes (as I know there’s a ton of those), these are simply online marketplaces where businesses like mine look for people like you who are hardworking, dedicated and skilled.

No matter where in the world you’re located, here’s what I know, you have a computer because you’re reading my online blog. If you have a computer, you can learn the skills needed to earn extra income online. This isn’t one of those “work-from-home” schemes (as I know there’s a ton of those), these are simply online marketplaces where businesses like mine look for people like you who are hardworking, dedicated and skilled.

I bet many of you would be shocked to find out you can learn to build websites at the highest level and become a programmer for free. Yep! And people around the world do it every day. There is an organization called World Wide Web Consortium (W3C) that was founded by the inventor of the world-wide web (that’s right, every time you enter “www.anything.com” remember the “www” was invented by one person), Tim Berners-Lee. And Berners-Lee believes the web should be open and everyone should be able to learn how to operate, create and build on it – for free.

Without sounding too techy, since this blog post is about finances and not technology and building websites, just know this: you can learn everything you ever needed to learn about building websites by going to: http://w3schools.com/ and everything you’ll learn will be 100% free. I’m always amazed at the number of people who say they want to learn programming but don’t know this resource is out there for free.

Maybe you have no desire to learn how to create websites or operate in that world known as the internet, there’s still plenty you can do. If you like talking on the phone, make yourself available as a customer service rep. If you type fast and your work is accurate, offer data entry services. Enjoy research (I’m a total research junkie), become a research specialist. And all of this can be done on sites like Elance.com, oDesk.com, Guru.com (and others I’ve not used yet but I know they exist).

Because I am in the technology business, this is what I think of immediately when someone tells me they’re willing to work more to get out of debt but just need to find a job. I tell them, if they’ve been looking and can’t find a second job…Create one. But technology isn’t the only way. You just have to get creative.  Have a family meeting and ask yourselves, what can we do together to bring more income into our home?

Have a family meeting and ask yourselves, what can we do together to bring more income into our home?

Once you’ve figured out a way to bring more income into your household, the important thing to remember is the purpose of this additional income is to pay off debt you’ve already incurred. Don’t go spending it. That defeats the purpose. Pretend this money doesn’t even exist; it comes in, you apply the 10/90 principle to it, and keep it moving. Keep your mind squarely focused on creating a Recession-Proof marriage and household and it will happen.

I’m excited about Wednesday’s journal post. I look forward to you joining me here.

Until Monday…make it a great weekend!

Comments: With more than 15,000 Happy Wives Club members already actively engaged on our Facebook page, what better place to share your thoughts? Join me there and let’s continue the conversation: Happy Wives Club Facebook

Fawn Weaver

Latest posts by Fawn Weaver (see all)

- Top 5 Regrets From the Dying: An Inspirational Article For Us All - November 12, 2017

- How to Protect Your Marriage During Challenging Times - October 19, 2017

- 5 Unique Ways to Make Your Man Feel Special in 5 Minutes or Less - September 16, 2017

Related Posts

Related Posts

Top 5 Regrets From the Dying: An Inspirational Article For Us All

How to Protect Your Marriage During Challenging Times

5 Unique Ways to Make Your Man Feel Special in 5 Minutes or Less

Recent Posts

Recent Posts

Top 5 Regrets From the Dying: An Inspirational Article For Us All

How to Protect Your Marriage During Challenging Times

5 Unique Ways to Make Your Man Feel Special in 5 Minutes or Less